New penalties for late submission of your VAT return

As we prepare your vat returns we thought we would let you know that there are now new penalties for vat returns that are submitted late and paid late for vat accounting periods after 1/1/2023, this also now includes nil and repayment vat returns. The new penalty...

Bevan Buckland LLP Tax Specialist Reflects on the Spring Budget

Leading Welsh independent accountancy firm, Bevan Buckland LLP, has given its reaction to this week’s spring Budget, as well as providing comment on the tax planning opportunities that the budget has created for businesses. Chancellor Jeremy Hunt has set out his first...Corporation Tax – Quarterly Instalment Payments and the Associated Companies Rules

In preparation for the upcoming corporation tax changes coming into force from 1 April 2023, Jack Parker, a Tax Senior Executive and joint head of our Cowbridge office, explains the new rate of corporation tax and details actions businesses can take

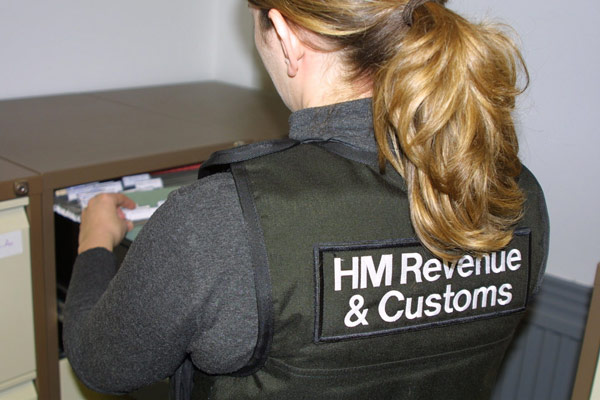

Join our Tax Investigation Service

We strongly recommend you consider subscribing to our Tax Investigations Service, the cost of which is dependent on your business turnover.