Transport and logistics – information for employers

Support for this sector of the economy is available and could include the following programmes

Support for this sector of the economy is available and could include the following programmes

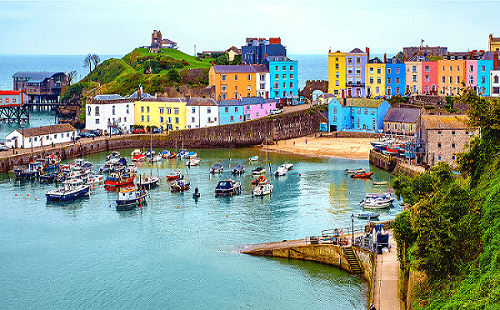

The Welsh Government has confirmed future developments must consider climate change effects like future flooding and coastal erosion risk. In Wales, developers will now also have to work with flood risk and coastal erosion maps. The Welsh Government have made these available today. The maps will show current risk levels as well as the risk posed by climate change.

Charitable organisations including housing associations and community interest companies (CIC’s) can apply for funding of up to £10,000

This brief explains that the introduction of the domestic reverse charge for construction services will be delayed for a period of 5 months

The government’s Self-Employment Income Support Scheme will be extended.

HMRC updated their guidance 4 May to outline the process for applying for SEISS.