The main challenge when trying to piece together a picture on the state of the Welsh economy is the lag time between national and regional data being available.

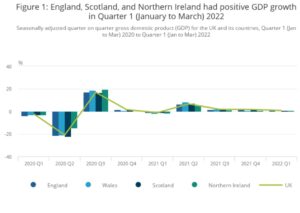

In May the ONS published its latest regional GDP data covering up to September 2022. That data paints a worrying picture for Wales. The Welsh economy largely outperformed the rest of the UK during Covid; however, the economy significantly underperformed the rest of the UK into the tail end of last year.

Source: Office for National Statistics – Regional GDP Estimate

Agriculture, Construction, retail/wholesale and household activities (paying third parties to carry out work at home such as care work, gardening etc) were the few industries in Wales to show some growth. One of the main drags was in manufacturing which declined 9.2%.

The other set of regional data published last month was the employment statistics up to March 2023. The news here was again not positive for Wales, with Wales dropping back down to the bottom of the league table and showing a worrying declining trend from its peak in 2018.

These sets or data are likely closely linked. The high rate of long-term sickness in Wales and an ageing population in many parts of the country are a significant drag on economic development. This has a double whammy effect, not only impacting immediate economic activity but people out of work do not develop new skills and that can exacerbate the relative decline.

A reversal of the covid driven growth in manufacturing, where we are seeing spending across the UK shift back from goods to services, along with continuing decline in post-Brexit trade are likely the headline factors dragging manufacturing activity down.

The question is where do we go from here?

Construction is a bellwether industry, so construction growth is a positive and ongoing investment in civil infrastructure, commercial development and housing is going to be key to the Welsh economy picking back up. Major initiatives like the South Wales Metro and green energy investments will have to do a lot of the economic heavy lifting, along with regeneration projects such as Swansea BID. Ongoing funding of these initiatives and ensuring the benefits of these investments are seen by local businesses will have a major impact on overall GDP.

A weakening housing sector is one of the major risks for the UK economy. Housing remains possibly the biggest single bottleneck to economic growth for Wales, and one that no one seems to have been able to come up with an answer for yet.

Recent good weather has provided some short-term positive news in retail and leisure, a strong tourist season this year could provide some economic relief for many businesses.

Inflation remains the canary in the coal mine. For the economic outlook to significantly improve we would need to see inflation not just fall but fall sharply over the next few months, any underperformance of inflation versus targets or inflation picking back up again after some falls over the next few months would be the biggest concern and signify potential further rate rises.

A further significant squeeze on household spending is what would tip the UK into recession. The upside risk to inflation continues to be food and energy, but also pent-up inflation in manufacturing and services where businesses have been absorbing price and wage increases through reduced margins. That pent-up inflation may start working its way into the figure later this year as demand stays flat or falls and businesses can no longer absorb their increased costs.

Many organisations have upgraded their economic outlook for the UK, predicting the country will avoid recession with overall household spending remaining stronger than often predicted, but persistent inflation coupled with rising housing and mortgage costs remains the key risk, and based on the latest data Wales may already be in a technical recession as service sectors drive growth in other parts of the UK, an area where Wales has long underperformed.

The reality is that without more people and more skills entering the workforce there is little GDP growth potential for Wales, the best we can hope for is a flatlining for the next 12 months. Renewable energy initiatives and other major investments may have the potential to create many thousands of new jobs but finding the people with the right skills and giving them places to live remain the fundamental long-term challenge.