Media coverage is full of increasingly frightening projections of household and business energy costs rising, with some forecasting that average annual household energy bills could rise from £2000 to £7000 in 2023, so what is actually happening? Gus Williams, the CEO here at Bevan Buckland LLP, provides an insight into the factors that are seeing our energy bills rise.

We are seeing new spikes in both gas and next day electricity prices, these are the market rates if you want to buy for next day delivery in the open market. The worst-case projections are just taking these prices and trends and assuming that they will stick. The first point to note is that no-one is really sure where these prices will be in the future. We can however try to understand what is driving them and what are the factors driving up bills in the UK.

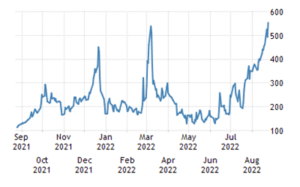

Natural Gas Prices

Natural Gas prices have been increasingly volatile and rising for a number of years. December 2021 saw a spike due to increased post-covid demand in Asia, issues with Russian supply, low stockpiles across Europe and cold weather. Prices again spiked when Russia invaded Ukraine but actually fell back down below the pre-invasion price in May. Since July prices have again been rapidly rising.

The key problem is that there is almost no redundancy or resiliency in global Natural Gas supply lines at a time when countries have been switching from high carbon coal and oil to lower carbon gas for electricity generation.

Unlike oil, which can be put in a barrel or tanker and transported anywhere, Natural gas has to be piped through physical infrastructure or transported at high pressure using specialist ships and port facilities. This requires large investment and small issues can dramatically impact supply – only one valve needs to be faulty on a 1000-mile-long pipeline and that pipe is out of action. Global supply limitations and growing global demand equal higher prices and increased volatility.

Since July this year Russia has been restricting gas supply, citing technical or maintenance issues. At the same time, the German government has underwritten loans to energy companies to go out and buy gas to ensure their storage is full before they head into winter. So on the one hand we have restricted supply, and on the other a major buyer in the market who will buy at almost any price, causing panic buying by others. This is not surprisingly driving up prices to record levels.

The Situation in the UK

The UK is facing some of the highest energy prices in the world. The UK is highly dependent on natural gas, around 30-40% of our electricity comes from gas but more importantly 80% of homes are heated by gas.

On top of that we have a unique energy market. The way the UK energy market is regulated means that most businesses and consumers get their energy from middlemen, who buy electricity and gas on the wholesale market and supply it to customers at business or domestic rates. The idea is that these middlemen compete to provide the best price to consumers. This model depends on stable wholesale prices and the middlemen being able to efficiently hedge their operations. This works when prices are stable but does not work when prices are volatile. Hedging becomes extremely expensive or impossible in current markets, hence a number of providers have gone bankrupt, and once current hedges expire consumers quickly become liable for the higher wholesale prices. Electricity generators and gas producers have no incentive to lock in long term supply prices for consumers as they don’t carry the pricing risk.

The UK also has limited gas storage capacity, this was a decision based on cost. Given most of our gas comes direct by pipe from the North Sea or by ship from Qatar through Milford Haven it was assumed that friendly relations and the relative security of these routes meant that long term storage capacity was not necessary. This is unlike places like Poland who have invested in storage capacity to mitigate the risks of Russian supply lines. This leaves the UK market more vulnerable to short term market price movements.

Lack of Redundancy in the European Electricity Market

The UK and the rest of Europe are also dependent on electricity connections between countries to provide resiliency and redundancy. The idea is that if a power station is taken offline in the UK for maintenance, the UK can buy electricity from excess capacity in France or the Netherlands. This model is replicated throughout the continent and works to deal with short term regional fluctuations in supply and demand. However, if every country on the network is facing the same supply problems there is no redundancy in the system as a whole, driving up prices as countries compete to secure electricity supplies. This model is cheaper in theory because it means individual countries don’t have to build expensive redundant generating capacity, however the system breaks down if there are supply issues everywhere, hence we are seeing Germany scrambling to bring old coal power stations back online.

Lack of investment

Political reluctance to invest in fossil fuel and nuclear generating capacity at the same time as not enough investment in renewables and new technologies, mean that across Europe there has been under investment in energy infrastructure. Covid lockdowns also meant that a lot of maintenance and investment was halted or slowed for 2 years. This lack of investment is having an impact on prices as infrastructure creaks and demand exceeds supply.

Where next?

It is probable that current gas prices will fall back, a slowing global economy will reduce demand and current prices are a consequence of both “real” money and speculative money which is likely temporary. However, there remain some big unknowns and we don’t know where, when and if gas and electricity prices will stabilise.

The main question is what will Russia do? They want to scare European markets as much as possible to create political pressure for a negotiated settlement in Ukraine. Eventually though this strategy becomes self-defeating. Russia will not want to get to a point where European buyers have secured alternative long-term supplies – at some point Russia needs its European customers to return and will not want to risk them never coming back. It’s a question of brinkmanship.

The fundamental and structural problems in the gas and electricity generation markets in the UK will remain though. Gas prices are likely to continue to peak and trough, making future costs to consumers and businesses hard to predict. The midterm solutions are greater efficiency savings, The longer-term solution is investment in infrastructure, renewables, new technology, nuclear and the US becoming a major gas producer, but all this needs funding and the investment will take years.

The reality is that there is little the UK Government can do in the short term to solve these issues, hence the heightened concern and uncertainty. We should all hope for a mild winter. [Note since writing this, gas prices have started to fall after Germany announced its storage facilities were almost full]

The next big political issue for Wales?

According to various sources Wales is one of the largest electricity exporters in the world, exporting over half the electricity we produce, and is near the top of per capita renewable energy production lists. Wales is almost at the point where it could meet all of its own energy needs from renewable sources. Welsh consumers and businesses are currently seeing little direct benefit from this. Could energy self-sufficiency be the next big political battleground in the devolution and independence debate? This would quickly resonate with voters if wholesale prices remained high and average bills do rise to £7000 per year.