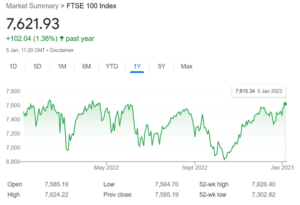

As we enter 2023 the FTSE 100 is touching new highs, so it begs the question: where do we stand after all the political turmoil of 2022 and where are we heading in 2023? Gus Williams, the Chief Executive Officer here at Bevan Buckland LLP, considers the likely impact that the current economic environment will have on Welsh businesses, as well as provides further detail on how the landscape may progress during 2023.

Inflation, the cost-of-living crisis, and rising interest rates have been the big economic themes of 2022. Those on low incomes are suffering real financial pain, with tough decisions on heating or eating being the reality for some, and many more are seeing a fall in real incomes.

We may or may not be in a technical recession. To some extent, the UK’s economic contraction is hidden by the fact that the economy did not fully recover from the pandemic, but we have not seen any significant contraction in GDP across any of the major economies.

In financial markets the prices of highly speculative assets have fallen significantly, e.g. Bitcoin, Tesla and tech stocks. Some of the more bubble-driven activities have also drained away – things like the SPAC boom of 2021 have all but fizzled out. The UK markets have followed a bear rally pattern – regular sell-offs on economic concerns only for buying to return and values to recover.

In short, through 2022 we have seen most of the speculative froth come out of global markets and spending patterns have changed with falling living standards, but consumer demand has not collapsed.

For a significant recession to materialise in 2023, one or a combination of the following would need to happen:

- Significant job losses –a significant number of people have left the workforce but employment remains high

- Significant credit tightening and debt default – although interest rates have risen, we have not seen any significant contraction in the availability of credit and we have seen no significant rise in debt default

- A significant crash in asset prices – house prices have fallen off the last few months but demand for housing is still there and financial markets have repeatedly recovered despite bearish pressures and sentiment.

Barring any major events, It therefore looks like the Welsh economy will muddle through for 2023.

Household savings are one factor propping up the economy, as is the tight availability of labour and continuing demand for housing. Many businesses are sitting on significant cash reserves and leverage, particularly in the banking sector, is nowhere near 2008 levels.

The downside risks to look for in 2023 will be:

- A steeper decline in house prices and rising mortgage defaults.

- We are seeing some significant layoffs in the US, particularly in the tech sector, so watch for any spill over into the UK

- Overleverage in private equity, venture capital and the shadow banking system leading to liquidations

- The “great liquidation”. The pandemic saw the “great resignation”, with older workers leaving the labour market. The risk this year is older small business owners who are facing rising costs deciding to simply cease trading and liquidate.

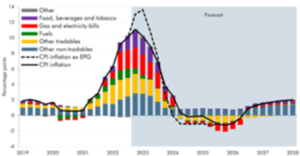

Where I retain most scepticism for 2023 is in relation to current inflation forecasts.

Source ONS OBR

Looking back at historical inflation, it is hard to find an example where inflation returns to a stable 2% in such dramatic fashion as the OBR are forecasting, at least without a significant recession that supresses demand in the economy.

Inflation will fall back in 2023 from its highs, as some numbers roll out of the year-on-year comparison, but I think there is significant risk that inflation will creep back up in late 2023 and into 2024. A big risk here is food price inflation, poor harvests or other issues impacting global food supply could have a significant impact on inflation. More generally the above forecast ignores how pervasive inflation can easily become. We could see some economic confidence return in 2023 but the risk to the economy for me is entering a more sustained period of stagflation through 2024, requiring yet more interest rate rises and more decisive action.

The thing to watch is what the US Fed does with rates through 2023, and how high it is prepared to go. It seems that the US Fed sees the risk of pervasive inflation as a bigger threat than other central banks, but those other central banks may have to follow their lead. One suspects the Fed would rather keep tightening through 2023 with a view to loosening in 2024, the next election cycle.

The Welsh Government also published their latest Chief Economists Report in December. A few things are worth noting:

The Welsh economy rebounded from Covid lockdowns more strongly than other parts of the UK – likely driven by manufacturing.

As discussed here previously, demographics and the ageing population are identified as a significant risk to the Welsh economy – the Government seems to recognise that inward migration will be required to maintain the Welsh working age population in the future.

Job creation in Wales has been strong but uneven, with Cardiff outperforming most.

The Welsh productivity gap lies not in manufacturing but in the service sector. The report highlights the lack of connectivity in Wales and lack of a major conurbation as likely factors. Large conurbations attract larger concentrations of service industries. This larger skills base (more skilled employees who can move around) and competition drives innovation and productivity. London, Manchester, Scotland (Edinburgh) etc all benefit from this.

The big long term issue facing Wales in particular, and the UK as a whole, is fiscal sustainability – the ability of the Welsh government to raise enough taxes (or grant funding) to sustain public services. Economic growth is vital to fiscal sustainability, however significant public investment in infrastructure and services is required to facilitate that growth. This is a huge political challenge for Wales.