Coronavirus Job Retention Scheme (CJRS) claims for July can now be submitted and must be made by Monday 16 August.

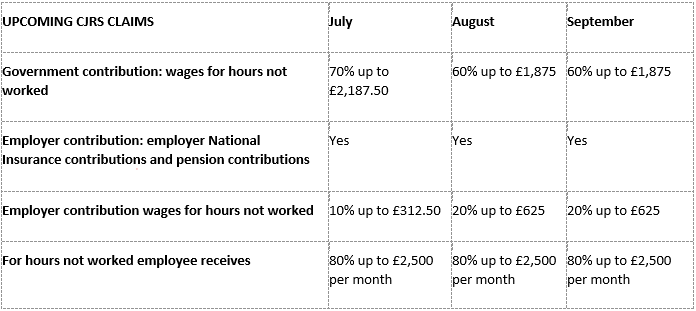

Employers can claim 70% of furloughed employees’ usual wages for the hours not worked. These are up to a cap of £2,187.50 per month. They will need to pay the difference, so that they continue to pay furloughed employees at least 80% of their usual wages in total for the hours they do not work, up to a cap of £2,500 a month.

Employers can still choose to top up employees’ wages above the 80% level or cap for each month if they wish, at their own expense.

From 1 August 2021, the government will pay 60% of wages up to a maximum cap of £1,875 for the hours the employee is on furlough.

The 60% support will continue until the end of September.

Once you’ve claimed, you’ll get a claim reference number. HMRC will then check that your claim is correct and pay the claim amount by BACs into your bank account within 6 working days.

When the scheme closes, you must decide to either:

- bring your employees back to work on their normal hours

- reduce your employees’ hours

- terminate their employment (normal redundancy rules apply to furloughed employees)

See: Claim for wages through the Coronavirus Job Retention Scheme – GOV.UK (www.gov.uk)